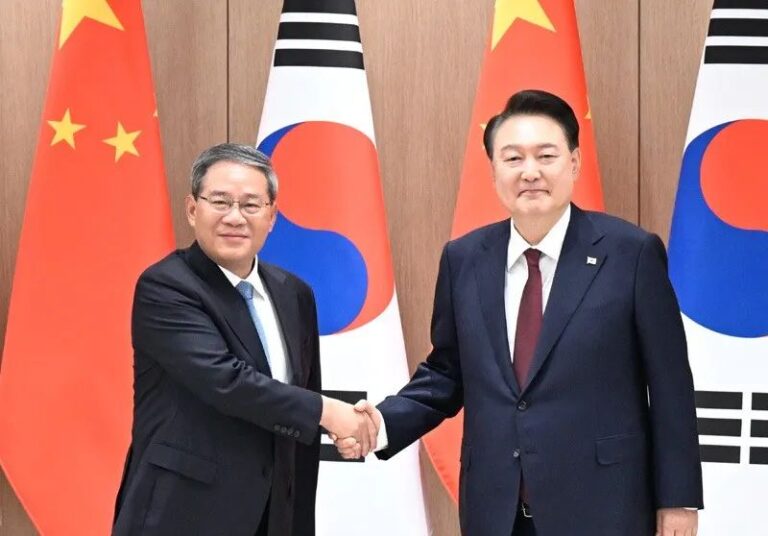

Russian President Vladimir Putin visited China and met with the heads of state of China and Russia

Putin recently paid a state visit to China. This is the 23rd time for Putin to visit China or attend international events in China. The two heads of state jointly signed and issued the Joint Statement between the People’s Republic of China and the Russian Federation on Deepening the Comprehensive Strategic Partnership of Coordination in the New Era on the occasion of the 75th anniversary of the establishment of diplomatic ties between the two countries, covering the orientation and development of the current China-Russia relations, practical cooperation in various fields, international cooperation and the Ukraine crisis.

The value added of industrial enterprises above designated size increased by 6.7% in April

According to the National Bureau of Statistics, in April, industrial production above designated size increased by 6.7% year-on-year in real terms (all growth rates are adjusted for price factors). From a month-on-month point of view, in April, the industrial added value above designated size increased by 0.97% over the previous month. From January to April, the added value of industrial enterprises above designated size increased by 6.3% year-on-year.

On May 17, the offshore RMB depreciated against the dollar and euro and was unchanged against the yen

The offshore RMB weakened slightly against the US dollar on Saturday, trading at 7.2320 as of press time, 110 basis points weaker than the previous close of 7.2210.

The offshore RMB weakened sharply against the euro on Saturday, trading at 7.8596 as of press time, down 155 basis points from the previous close of 7.8441.

Offshore RMB was unchanged against 100 yen on Saturday, at 4.6400 yen as of press time, unchanged from the previous close of 4.6400 yen.

On May 17, the onshore RMB depreciated against the dollar, appreciated against the euro and was unchanged against the yen

The onshore RMB weakened slightly against the US dollar on Saturday, trading at 7.2254 as of press time, 55 basis points weaker than the previous close of 7.2199.

The onshore RMB strengthened slightly against the euro on Friday, trading at 7.8499 as of press time, up 1 basis point from the previous close of 7.8500.

The onshore RMB was unchanged against 100 yen on Friday, at 4.6300 as of press time, unchanged from 4.6300 in the previous trading day.

On May 17, the central parity rate of the RMB weakened against the US dollar on Friday and strengthened against the euro and yen

The RMB weakened slightly against the US dollar on Friday, with the central parity rate of the RMB at 7.1045 per dollar, down 25 basis points from 7.1020 in the previous trading day.

The RMB strengthened slightly against the euro on Friday, with the central parity rate of the RMB against the euro at 7.7446, up 52 basis points from the previous trading day of 7.7498.

The RMB strengthened sharply against the 100 yen on Friday, with the central parity rate of the RMB at 4.5959, up 282 basis points from 4.6241 in the previous trading day.

Brazil’s exports to China rose 8.8% in the first four months of the year

According to the latest statistical report released by the Brazil-China Entrepreneurs Council (CEBC), the trade between China and Brazil continued to grow in the first four months of this year, and the bilateral trade volume has exceeded 50 billion US dollars to reach 51.5 billion US dollars. In the first four months of this year, Brazil’s exports to China rose 8.8% year-on-year to $32.7 billion. Exports to Brazil rose 14.5% year on year to $18.8bn. Brazil has a $13.9 billion trade surplus with China.

The Danish government expects the economy to grow by 2.7%

Recently, Denmark’s economy ministry has raised its forecast for gross domestic product (GDP) growth in 2024 to 2.7%, up from a December estimate of 1.4% and almost double its previous forecast. Denmark expects GDP to grow by 1.8% by 2025, up from a previous forecast of 1%.

Israel’s GDP grew 14.1% in the first quarter compared with the previous quarter

According to data released by Israel’s Central Bureau of Statistics, in the first quarter of 2024 (January-March), Israel’s gross domestic product (GDP) grew at an annualized rate of 14.1% quarter-on-quarter. Since the outbreak of a new round of Israeli-Palestinian conflict in October last year, the Israeli economy has suffered a severe contraction at the end of 2023.

Amazon plans to invest 1.2 billion euros in France

Us e-commerce giant Amazon will invest more than 1.2 billion euros in France, creating more than 3,000 jobs, French President Emmanuel Macron’s office has said. A statement added that the funding will be used to develop cloud infrastructure for Amazon Web Services (AWS), primarily to generate artificial intelligence, as well as logistics infrastructure for package delivery services.

Temu officially opens the OBM entry channel

Recently, Pinduoduo’s cross-border e-commerce platform Temu officially launched the OBM channel. As a new business supply model, OBM channel for domestic single store annual sales of more than or equal to 1 million RMB brand merchants, has been open to men’s wear, sports outdoor men’s wear, maternity wear three categories of investment. In addition, merchants must publish more than 50 product SPUs, and the old main store and its sub-stores cannot enjoy benefits.

Cma CGM announced new routes with six shipping companies

CMA CGM, the world’s leading shipping company, has announced a major strategic initiative to form an alliance with six shipping companies in the Asian region. The alliance includes six Asian Shipping companies, Emirates Shipping Line, PIL, RCL Feeder, KMTC, CU Lines and Global Feeder Shipping.

UPS opens new distribution center in Munich, Germany

Recently, UPS recently opened a new distribution center in Kirchheim, near Munich, Germany, to expand capacity and accelerate decarbonized distribution. The new distribution center covers an area of approximately 20,900 square meters, including approximately 9,100 square meters of lobby space and 2,100 square meters of office space. The site will be equipped with an extensive electric vehicle charging infrastructure that will allow UPS to expand its electric fleet.

Alibaba’s fourth-quarter revenue rose 7% from a year earlier

Recently, Alibaba released its financial results for the fourth quarter and full year of the 2024 fiscal year ending March 31. In the fourth fiscal quarter, revenue was 221.874 billion RMB, an increase of 7% year-on-year, exceeding market expectations. For the full year of fiscal 2024, revenue was 941.168 billion RMB, an increase of 8%. Net profit was 71.332 billion RMB, up 9% year on year; Excluding GAAP, net profit was 157.479 billion yuan, an increase of 11%.

Mercedes-benz group net profit fell 25% in the first quarter from a year earlier

Recently, Mercedes-Benz Group announced the first quarter of 2024 financial results. Quarterly revenue was 35.873 billion euros (approximately $38.6 billion), down 4% from 37.516 billion euros in the year-ago quarter. Quarterly adjusted EBIT profit was €3,598 million, compared to €5,422 million in the same period last year, down 34%. Net profit for the quarter was €3.025 billion, compared with €4.011 billion in the same period last year, down 25%.

The low altitude route is coming

Recently, the Beijing Municipal Bureau of Economy and Information Technology has publicly solicited opinions on the Action Plan for Promoting High-quality Development of Low-altitude Economic Industries in Beijing (2024-2027)(Draft for Comments). According to the draft, Beijing will build application scenarios around emergency rescue, logistics distribution, air ferries, intercity commuting, and characteristic cultural tourism, and open more than three low-altitude routes for surrounding areas.